Mortgage services

FIRST TIME BUYERS

Making that first step onto the property ladder is an exciting period in anyone’s life. But let’s face it, it can also be a daunting and expensive one.

So, it’s really important to choose the right lender and type of mortgage for you, in order to get the best deal. This decision could potentially save you £1,000s of hard-earned money over your loan period.

But picking the right lender can be like navigating a minefield — there are thousands on the market. So, where do you start?

Well, we can help. We have years of experience and access to the whole of the market, meaning that we do the leg-work for you — finding the best options, tailored for you and your financial situation.

Please note, your home may be repossessed if you do not keep up repayments on your mortgage.

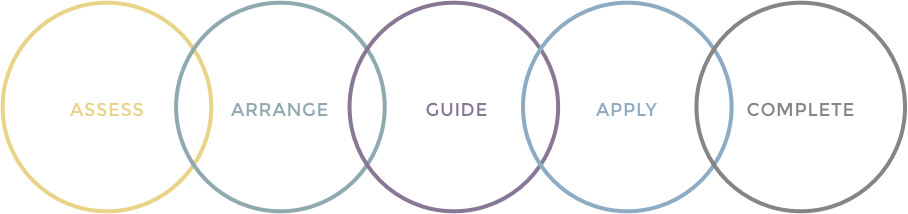

THE PROCESS

We’ll thoroughly assess how much you can borrow, what your monthly repayments will be and how much deposit you’ll need to save. Then we’ll present your mortgage options, negotiate an offer on the property, provide you with access to our recommended surveyors and solicitors, help you through the mortgage application process and congratulate you when you finally move in!

But most importantly, throughout the whole process, we’ll potentially save you money, time and hassle.

So, if you’re looking for a mortgage advisor in Huddersfield, Brighouse or Yorkshire, get in touch.

And don’t forget, if you’re buying a home, you might also want to consider building & contents or mortgage protection insurance — we specialise in all areas of protection advice too.*

Please note: your home may be repossessed if you do not keep up repayments on your mortgage.

*As with all insurance policies, conditions and exclusions will apply

HEAR FROM OUR CUSTOMERS WHO’VE TRIED AND TESTED OUR SERVICES: