Our approach

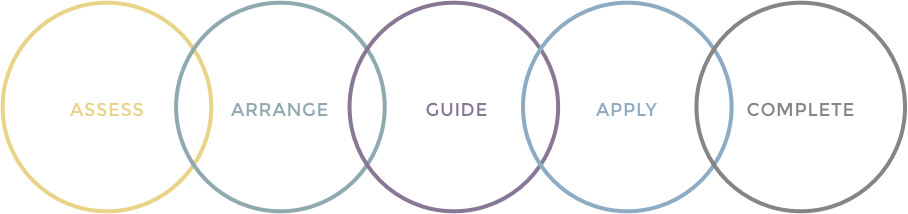

OUR MORTGAGE PROCESS

ASSESS

After a discussion on your property needs we’ll undertake a thorough fact-find to evaluate how much you can afford. We will take your financial situation into account and create a detailed income and expenditure. Then, we’ll provide you with your options, offer our expert advice and answer any questions you might have.

ARRANGE

Once you are comfortable with your affordability, we’ll approach the chosen lender for an Agreement-In-Principle. This will ensure that you are able to borrow the amount that you need to secure a house and put you in the best position possible for when you come to find the home you love.

GUIDE

When you’ve found the right property for you, we can help to negotiate an offer with the estate agent and put you in touch with our approved solicitors and surveyors.

APPLY

Next, we’ll apply for your mortgage, fill out all the paperwork, provide you with our protection recommendations and keep you up-to-date throughout the buying process.

COMPLETE

Once your solicitor is satisfied, they’ll request your deposit and set the date for getting your keys. You’ll exchange contracts and finally go through completion. Then, we’ll congratulate you when you move in! We’ll even get in touch when your fixed period is coming to the end, to review your options and ensure that you’re continually getting the best deal.

Please note: Your home may be repossessed if you do not keep up repayments on your mortgage.

HEAR FROM OUR CUSTOMERS WHO’VE TRIED AND TESTED OUR SERVICES: