This month, KB Mortgage Services turns five, so to mark the occasion, we asked Kate to reflect on the past year, looking at how COVID impacted the business and the ups and downs of building her own home…

How did COVID impact you day-to-day?

Thankfully, my client base didn’t particularly change, and I was able to adapt quickly by offering appointments over the phone or by Zoom/Teams meetings. In terms of dealing with lenders, there hasn’t been much change – documents have always been sent electronically.

However, I much prefer working in the buzz of the office and going out to meet people, so I really missed that interaction with clients. I also tend to use the gym as a way of switching off from work, so not being able to hit the gym after work was another big change for me.

Were there any benefits?

I did miss the face-to-face interaction, but I realised that a lot more time can be saved by doing things online.

Not travelling to meetings was a benefit, for example. I also found that clients were emailing me documents upfront, before our call, meaning that I could prep before our meeting rather than waiting to see them and then having to scan in the documents. That’s something that will be our standard practice from now on.

Did it change the availability of products?

At the beginning of lockdown, all of the 95% Loan-to-Value products – and most of the 90% ones – were removed from the market, which was difficult, especially for first-time buyers.

There were only a couple of lenders that had 90% on offer which caused issues with service levels and product availability. Some of them were putting out products for a couple of days only or made them available daily on a first come first basis which was really difficult. It was like trying to get Glastonbury tickets and it would freeze all the time!

Let’s talk about your new home… Did you always want to build your own house?

The house I demolished had been stood derelict for around 15-20 years and was basically rotting.

It had been in my family for many years, and whenever I saw it, I said I would love to build a house there!

What were the challenges?

There were many challenges – none of which I could’ve prepared for, such as planning issues, land being contaminated and extra, unexpected costs.

There are lots of things that can go wrong when building a new house, it certainly isn’t straightforward and was very stressful at times. The timescales were challenging too – it was full-on for a very long time.

What’s the best thing about building your own home?

The best thing for me is the outcome and having been able to choose everything that I want.

However, as a very indecisive person, that was a downside too, as there were many decisions to make. I didn’t know it would be so difficult to decide how many plug sockets to have and where to position them. I kept questioning myself, so I found it difficult.

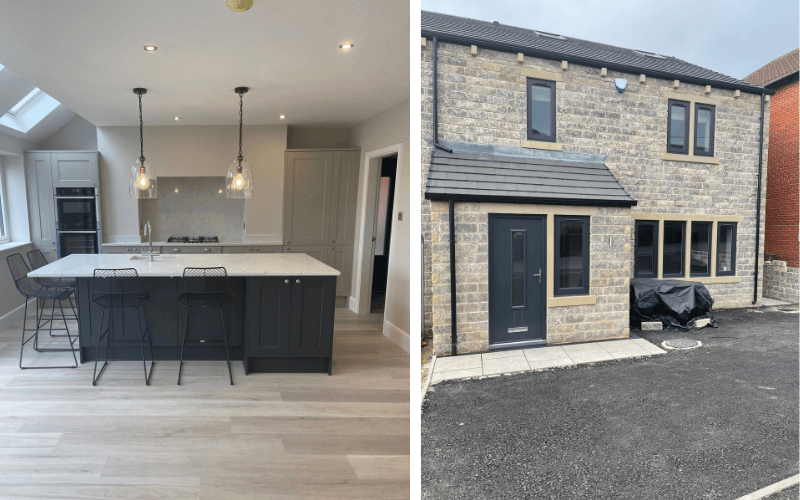

I’m just pleased that it’s all worked out and we now love it, particularly the kitchen/diner. I love the big open space.

How long did the build take?

The actual build took around 12 months, but the issues with planning delayed things so overall the project has taken over three years! Although I am living in the property now, it’s still not finished – we have the mammoth task of the garden to tackle.

Do you want to add anything?

Yes, I am really grateful to my clients for being loyal to KB Mortgage Services throughout the past five years – particularly within the last 12-18 months. They’ve adapted and embraced the changes we’ve had to implement due to COVID, and I want to thank them for that.

If you’re looking for mortgage or protection advice in Huddersfield, Brighouse or West Yorkshire, get in touch:

07834818805

[email protected]

How KB Mortgage Services can help:

- Help for first-time buyers

- Buy to let mortgages for investors

- Reviewing your current buy to let mortgages with remortgaging

- Mortgage protection insurance

Note: Your home may be repossessed if you do not keep up repayments on your mortgage. You may have to pay an early repayment to your existing lender if you remortgage. Second charge mortgages are arranged by introduction only.

Not all Buy to Lets are regulated by the financial conduct authority & we are unable to provide Inheritance or tax advice